Tag: tax-planning

-

Adoption Tax Credit Updates You Need to Know for 2025

IRS Tax Tip 2025-71 highlights updates to the adoption tax credit that can significantly reduce federal taxes for adoptive families. The credit has strict rules, documentation requirements, and income limits. Steve Perry, EA helps families claim the credit accurately, avoid IRS notices, and protect their refunds.

-

Steve Perry EA: Last-Minute Tax Strategies for 2025 Businesses

Steve Perry, EA delivers essential last-minute tax strategies for businesses as 2025 closes. Learn how to lock in valuable deductions, avoid IRS pitfalls, and prepare your entity for major tax law changes. Use these urgent tips to protect profits and optimize your bottom line before the year ends.

-

What Happens If You Default on an IRS Payment Plan

When you default on an IRS payment plan, the fallout is severe—garnishments, levies, credit damage, and sleepless nights. But there is help. Steve Perry, EA stands between you and the IRS, negotiating on your behalf and protecting what you have worked for. Do not wait until it is too late.

-

What the One Big Beautiful Bill Means for Business Taxes and How Steve Perry, EA Can Help

The One Big Beautiful Bill signed by President Trump in July 2025 introduces important tax changes for businesses of all sizes. It increases the deduction for pass-through business income from 20 percent to 23 percent through 2028, offering significant savings for sole proprietors, partnerships, and S corporations. The bill also restores full expensing for research…

-

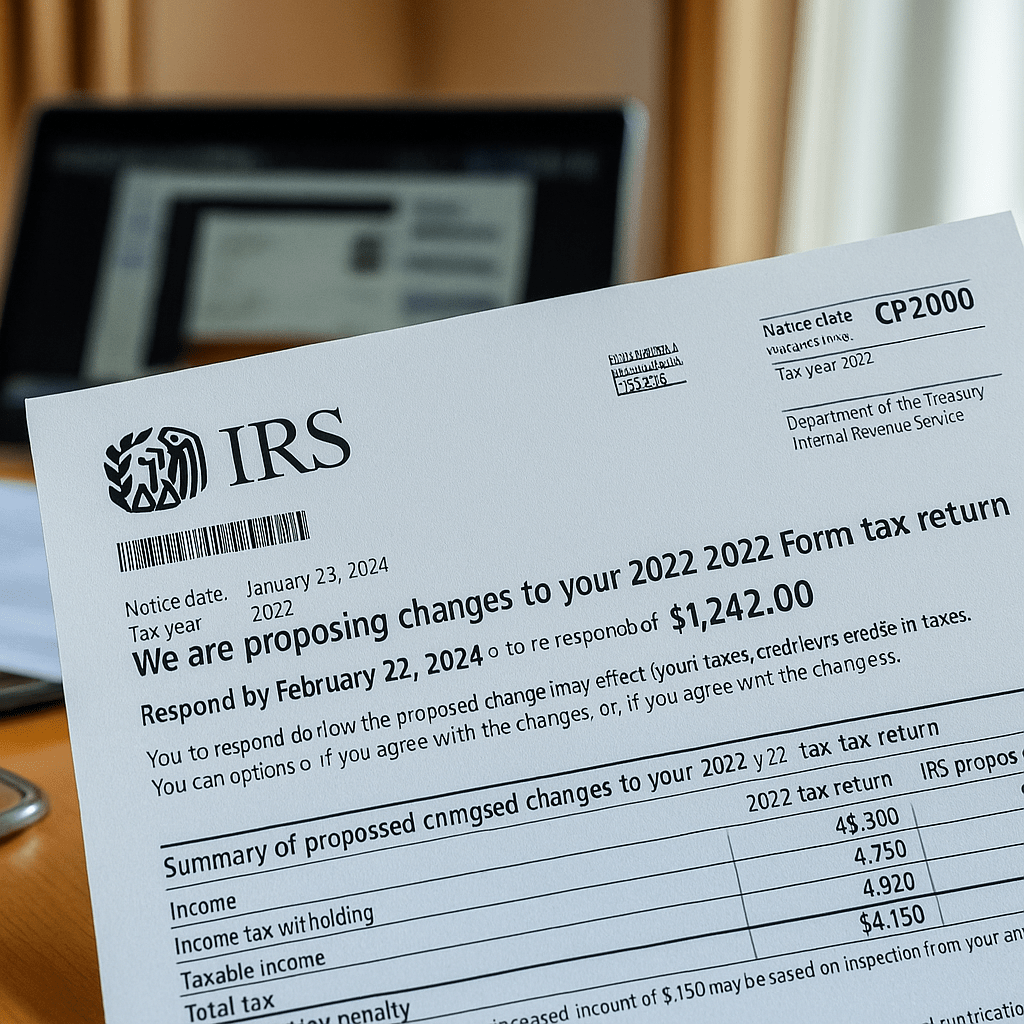

Understanding IRS Notice CP2000: What It Means and How an Enrolled Agent Can Help

The IRS Notice CP2000, generated by the Automated Under Reporter program, indicates discrepancies between reported income and third-party data. It includes proposed tax adjustments and requires a response. Taxpayers can agree, disagree, or partially agree with changes using an Enrolled Agent for assistance. Prompt, accurate responses are crucial.

-

Top Benefits of Hiring an Enrolled Agent for Tax Matters

When it comes to tax matters, facing the Internal Revenue Service (IRS) can be intimidating. Whether you’re being audited, owe back taxes, or need help navigating a complex tax issue, having the right professional by your side can make all the difference. One of the most powerful allies you can have in your corner is…

-

How Enrolled Agents Enhance Your Tax Documentation Strategy

Proper documentation is crucial when dealing with the IRS, particularly during audits. It validates claims, reduces penalties, and expedites processes. Essential records include receipts, bank statements, and tax forms. An Enrolled Agent can help organize these documents, represent taxpayers in audits, and mitigate risks, ensuring compliance and peace of mind.

-

Tax Relief Options: What To Do If You Can’t Pay Your Bill

Tax season can be stressful, especially for those facing a tax bill. It’s crucial to file returns on time to avoid penalties, and options exist for managing unpaid taxes, such as IRS payment plans, Currently Not Collectible status, or Offers in Compromise. Seeking professional help can prevent financial damage and clarify available solutions.