Tag: personal-finance

-

The IRS Knows Before You Do: 7 Tax Surprises

IRS automation and data matching mean tax problems surface faster than ever. This blog explains seven common surprises impacting 2026 tax returns and why proactive planning matters. Steve Perry, EA helps taxpayers respond to IRS notices, prevent penalties, and regain control before issues escalate.

-

Adoption Tax Credit Updates You Need to Know for 2025

IRS Tax Tip 2025-71 highlights updates to the adoption tax credit that can significantly reduce federal taxes for adoptive families. The credit has strict rules, documentation requirements, and income limits. Steve Perry, EA helps families claim the credit accurately, avoid IRS notices, and protect their refunds.

-

What Happens If Your Business Has Not Filed Taxes in Years

When your business has not filed for years, the IRS can create inflated returns, stack penalties, and seize assets. Steve Perry, EA steps in as your advocate, rebuilding records, filing accurate returns, and negotiating with the IRS so you can regain control and protect what you have built.

-

Steve Perry EA: Last-Minute Tax Strategies for 2025 Businesses

Steve Perry, EA delivers essential last-minute tax strategies for businesses as 2025 closes. Learn how to lock in valuable deductions, avoid IRS pitfalls, and prepare your entity for major tax law changes. Use these urgent tips to protect profits and optimize your bottom line before the year ends.

-

IRS Targets Cash Businesses: Steve Perry EA Shields Your Income

The IRS aggressively targets cash-based businesses, often assuming unreported income. Steve Perry EA knows the IRS playbook, fights back with precision, and protects hard-working entrepreneurs from devastating consequences. With his experience and calm approach, he gives business owners the defense they need when the IRS comes knocking.

-

What Happens If You Default on an IRS Payment Plan

When you default on an IRS payment plan, the fallout is severe—garnishments, levies, credit damage, and sleepless nights. But there is help. Steve Perry, EA stands between you and the IRS, negotiating on your behalf and protecting what you have worked for. Do not wait until it is too late.

-

What the One Big Beautiful Bill Means for Your Taxes and How Steve Perry, EA Can Help

The One Big Beautiful Bill signed by President Trump in July 2025 brings significant tax changes for individual taxpayers. It permanently extends the reduced income tax rates from the 2017 Tax Cuts and Jobs Act and increases the standard deduction for both single and joint filers. Families benefit from a higher child tax credit, while…

-

Understanding IRS Letter 3172 and How Steve Perry, EA Can Help

IRS Letter 3172 notifies taxpayers that a Notice of Federal Tax Lien has been filed due to unpaid tax debt, giving the IRS a legal claim on their property. This lien can severely impact credit, complicate financial transactions, and damage personal and professional reputations. Importantly, the letter offers a limited window, usually 30 days, to…

-

What Is IRS Notice CP59 and How an Enrolled Agent Can Help

When a taxpayer receives IRS Notice CP59, it means the IRS believes they did not file a required tax return. This notice is sent when the IRS has no record of a return being filed for a specific year, even though they have information that suggests one was required. While the notice itself does not…

-

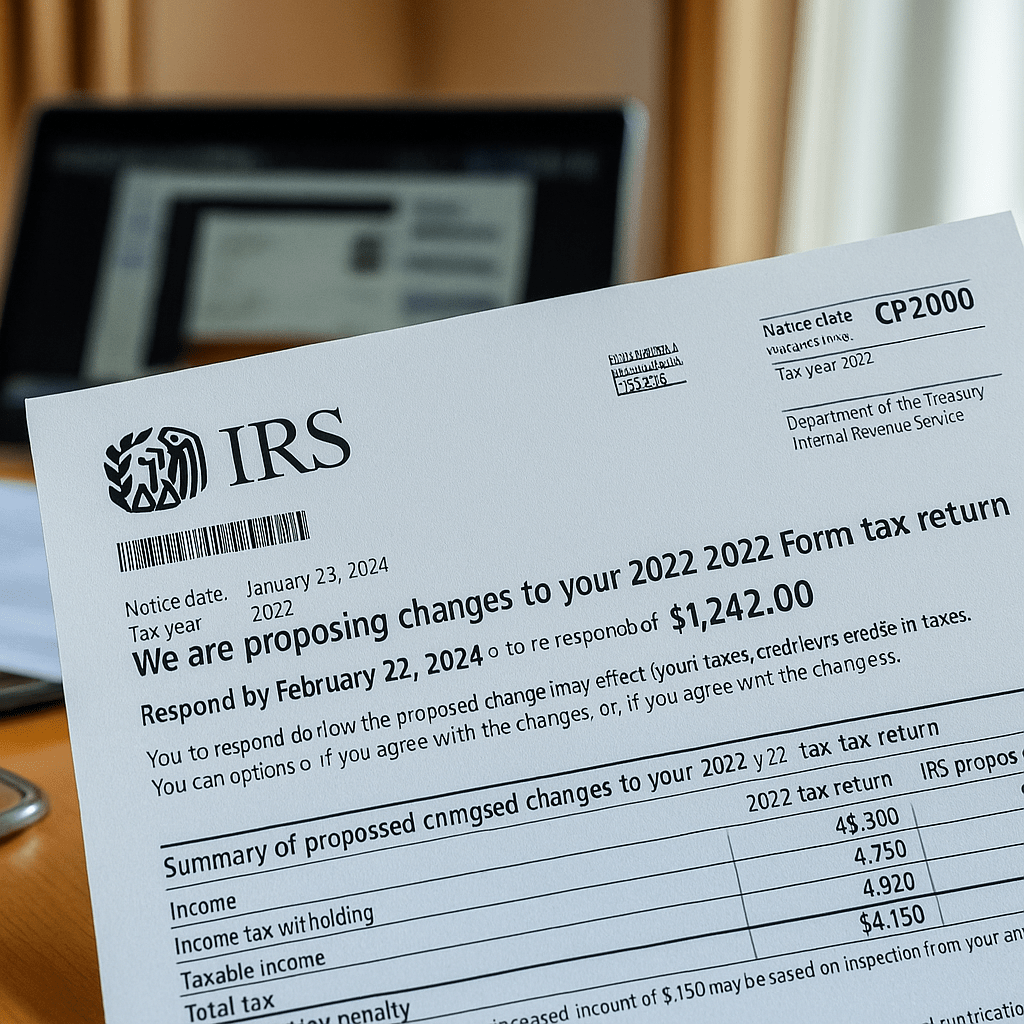

Understanding IRS Notice CP2000: What It Means and How an Enrolled Agent Can Help

The IRS Notice CP2000, generated by the Automated Under Reporter program, indicates discrepancies between reported income and third-party data. It includes proposed tax adjustments and requires a response. Taxpayers can agree, disagree, or partially agree with changes using an Enrolled Agent for assistance. Prompt, accurate responses are crucial.