Category: Tax Representation

-

You Received an IRS letter. Why You Need a Professional

Receiving a letter from the IRS presents various options based on your situation. For minor amounts, it’s wise to comply. However, for audits or larger debts, hiring a professional is crucial due to their legal expertise, experience, and ability to navigate complex communications with the IRS effectively.

-

The Dreaded Audit

The fear of IRS audits is common among taxpayers due to potential fines and legal issues. There are three audit types: correspondence, local office, and on-site audits, with varying levels of scrutiny. To minimize risks, maintain thorough records and seek representation. Books, Taxes & More offers advocacy for taxpayers facing audits.

-

The IRS: Unraveling the Fear Factor

Many taxpayers fear the IRS due to widespread myths surrounding its role. These misconceptions suggest the IRS seeks to punish individuals and is unapproachable. However, the IRS aims to ensure tax compliance and offers support to taxpayers. Understanding these myths helps alleviate anxiety and promotes confidence in navigating the tax system.

-

The Gig Economy

The gig economy, involving platforms like Uber and Airbnb, engages a significant portion of Americans. Participants must treat their roles as self-employed, reporting all income, including cash tips, to avoid penalties. Essential practices include diligent recordkeeping, understanding tax obligations, and utilizing deductions, often with professional guidance to minimize liabilities.

-

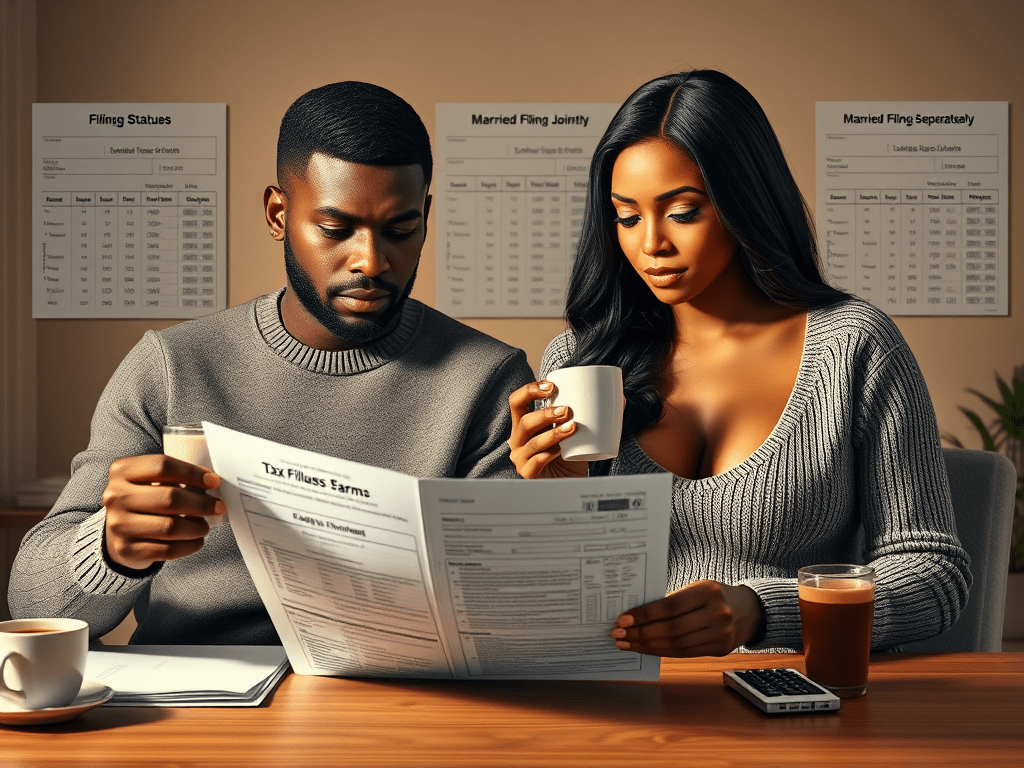

The Dangers of Not Understanding the Definition of Filing Status

Filing statuses are essential in tax returns, primarily defined by marital status as per IRS guidelines. Unmarried individuals file as Single, while those married can choose between Married Filing Jointly or Separately, affecting tax liabilities significantly. Special statuses like Qualifying Widow(er) and Head of Household apply under specific conditions. Accurate filing is crucial to avoid…

-

Taxpayer Bill of Rights

The IRS, known for its collection powers, also imposes limitations through the Taxpayer Bill of Rights. Proposed by Nina Olsen, this Bill outlines rights including informed service, quality assistance, and confidentiality. It emphasizes fair treatment and privacy. Taxpayers are encouraged to seek professional help to navigate complexities and avoid distressing experiences.

-

Tax Accounting & Representation

Tax accounting plays a crucial role in minimizing tax liabilities for individuals and business owners facing various taxes, including sales and income tax. A tax accountant aids in identifying legitimate deductions and provides insights into tax policy impacts, ensuring timely compliance and strategic financial decisions that enhance profitability while managing tax consequences effectively.

-

Latest Scam Report by the IRS

Scammers posing as IRS agents are increasingly using threats and deception to trick victims into purchasing gift cards. They typically create confusion about identity theft and demand immediate payment through specific methods. To protect yourself, hang up on suspicious callers, verify identities, and report scams to relevant authorities.

-

Insuring Acceptance of Correspondence by the IRS

The IRS only acts on received documents, which must be acknowledged. Many clients mistakenly believe their filings are submitted, yet the IRS denies receipt. To ensure proof, electronic submissions require confirmation, while mailed documents must be sent via certified or registered mail to confirm delivery and meet deadlines, essential for defense claims.

-

How long should a taxpayer keep records?

The IRS typically reviews returns for three years after filing, but it can extend to six years if more than 25% of income is unreported. In cases of fraud, there’s no limit. Taxpayers should maintain comprehensive records for potential audits, especially related to significant transactions like property sales.